Venture Capital – A very brief summary

Venture capital is the activity of investing in companies during the early stages of their life. Venture capital funds work with companies that have a high technological and innovative potential and aim to grow and scale the market quickly, for example start-ups and innovative SMEs. A venture capital fund injects capital into the startup, and introduces other important elements such as management skills and professional network. The investor aims to enhance his participation in a few years, usually from 3 to 7 years (average 5 years), by reselling the startup to other market players.

The role of Venture Capital in the life of a startup

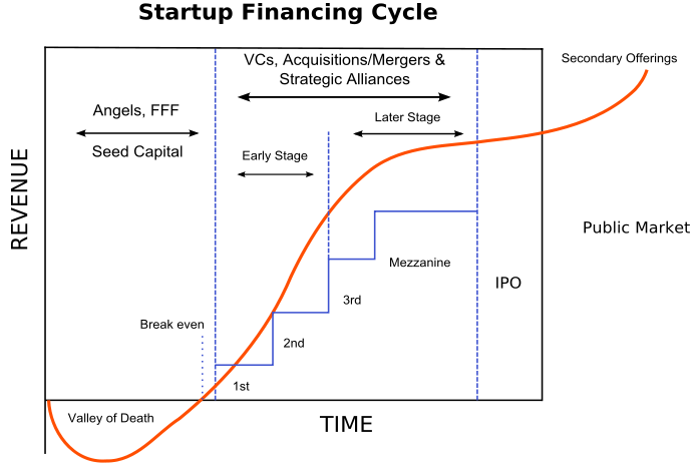

The graphics above represent the scenario of possible funding of a startup during its life. It can be seen that the venture capital comes into play during a precise phase: not when the company is starting up but when it has already validated its product or service on the market, and when the relevant metrics show an important growth.

The investment flow of a Venture Capital Fund

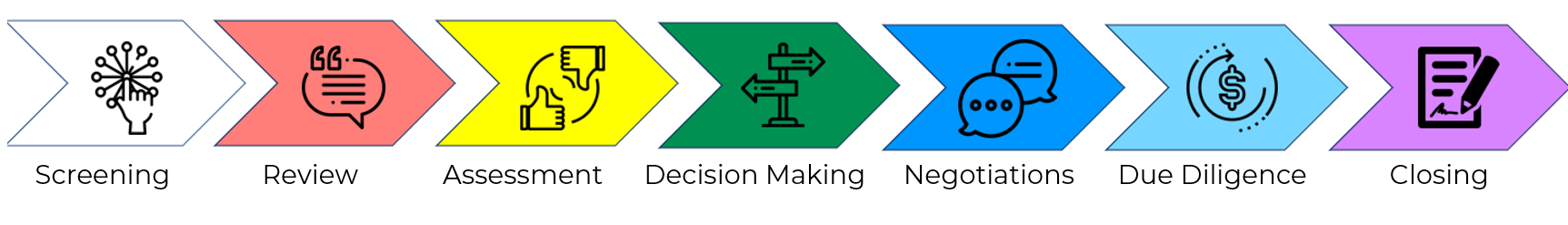

One of the most frequently asked questions by entrepreneurs is “how does the investment flow of a venture capital fund work? This graphic summarises how the process is structured.

During the deal flow process, a number of opportunities reach the fund through a network of advisors or partners. The first step is the screening of projects, to select the most targeted ones. Then there is a review phase, which involves a more in-depth reading of the startup documents, usually the pitch and business plan, but also balance sheets and metric models. Another element of the review phase is a meeting between potential investors and the company’s founders.

Once all the necessary information is gathered, the VC’s fund moves on to a more in-depth assessment, analysing all the available data and then deciding whether the company fits the fund’s target during the decision-making process.

For startups that pass the assessment phase, the next step is the negotiation of the offer, with a technical and commercial due diligence on the product or service offered by the startup, focusing on the potential scalability of the business and the validity of the solution on the market.

If these last two steps are positive there is a bidding phase by the fund with signatures and the closing of the transaction.

It is an extremely delicate and complicated process that requires time and expertise. BizPlace offers strategic support in managing capital increase deals – to find out more about venture capital fund financing or to ask us a question, please contact us by clicking the button below.