What is a SPAC?

The Special Purpose Acquisition Company (SPAC) is a company listed on the Stock Exchange for the purpose of acquiring private companies with the aim of also making them listed. The SPAC is therefore an investment tool , accessible to institutional and individual investors, as an alternative to the classic forms of private equity as it allows the structuring of acquisition transactions in shorter timescales and limiting risks.

As an alternative form of private equity, the SPAC were born in the United States in the 1990s and entered Italy in 2011, listed on two markets regulated by the Italian Stock Exchange: AIM (Alternative Capital Market), the Italian market segment consisting of SMEs with high growth potential , and MIV (Electronic Vehicles Investment Market ).

How does a SPAC work?

The Special Purpose Acquisition Company is a vehicle company listed on the stock exchange that began as an empty investment fund with the aim of acquiring small unlisted medium-sized companies , making them public in faster times and with less risks than the traditional IPO process. Focusing on specific investments in specific sectors or geographical areas, it requires a team of industry experts and financial operators specialized in Mergers & Acquisitions operations . For this reason, the SPAC is created by high-profile managers, defined as sponsors , who collect liquidity from institutional investors (and others) in order to invest in a target company before expiration (generally expected within 24 months). The team of specialists has time until the deadline to identify the target , proceed with the due diligence and negotiate the terms of the operation; in the event that a target company is not identified in the time frame envisaged, the vehicle company must liquidate the funds and repay the shareholders.

What are the benefits?

- Liquidity: unlike private equity investments , which are characterized by a high liquidity risk, SPAC shares are liquid and traded on the stock exchange;

- Repayment right: as indicated above, the sponsors are fully reimbursed if a target company is not identified within 24 months;

- Right of withdrawal: in order to complete the acquisition, called business combination , the approval of 70% of the shareholders’ meeting is required; however, the minority can choose to exit the investment and fully recover the invested capital;

- Warrants: in exchange for the payment of capital, the investor, in addition to obtaining the respective share of ordinary shares, receives warrants that can be converted into listed shares of the company resulting from the business combination;

- Alignment of interests: a capital commissioning is also envisaged by the sponsors , of approximately 2-4%, which exposes the management team to the same risk profile as the investors, encouraging their performance; furthermore, the management does not receive compensation, but only receives a share of the target shares if, in the long term, they maintain a certain price level.

Growth prospects in Italy?

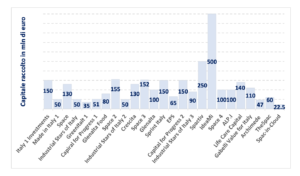

The Special Purpose Acquisition Companies are establishing themselves in the Italian market as an easy and fast investment vehicle through which to list companies in the AIM Italia market. In fact, these vehicles are created as a channel to invest in unlisted SMEs or in small emerging companies . To date, from January 2011 to November 2018, 25 SPACs have been listed on the AIM Italia, with total capital raised of around 2.9 billion euros (Source: BeBeez Spac Report Dec – 2018).

One of the largest acquisition operations through SPAC in Europe was carried out by Spaxs , SPAC of the former Minister of Economic Development, Infrastructure and Transport of the Italian Republic Corrado Passera. His Spaxs , at the beginning of 2018, had already raised € 600 million and in July he was able to acquire Banca Interprovinciale. This business combination has created a new credit institution, Illimity Bank , which presents itself with an innovative and high-tech business model, with the focus of its credit services on Italian SMEs.

The BizPlace Team