Investments: Long Term or Short Term?

Federico Palmieri

When it comes to investment, a question that often arises is <<should I invest in the long term or the short term? >>.

Even before thinking about where to invest the capital or in which asset, the time frame in which to invest your savings is one of the first obstacles. This is perhaps one of the most discussed topics by industry leaders, from private bankers to savings managers and investment houses. Anyone entering the investment world needs to think about it.

It is necessary to make a point: there is no better or worse strategy. Each of the paths are and will be taken by different people: for example, by you, your private banker, the fund that manages your money or your bank. Each of us has a different past, a different background and different perspective; in other words, there are factors that shape the way we invest.

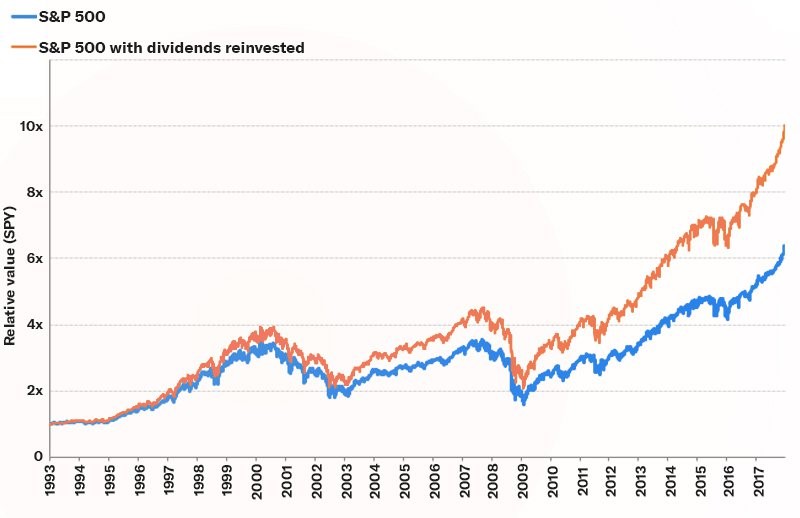

For example, some very patient investors prefer to keep their savings for 15-20 years, while others prefer to see the fruits of their investments immediately (this could be the case with traders waiting for momentum investing). Other types of investors carefully evaluate the asset to invest in, so we could consider preferences for short to medium term asset classes, for example startups, or for medium to long term asset classes, for example index funds, real estate, accumulation plans and government bonds. The choice also depends on the liquidity requirements, which vary from person to person. Another criterion in fact is based on the expected returns of each investment: those who prefer to reinvest dividends in the long term will certainly have a higher return, but a delayed liquidity; on the contrary, those who aim to get refunds in the short term (in most cases, but not always) will tend to get lower returns, but an injection of liquidity in the short term.

Those who invest in companies over the long term do so with a single awareness: if I bet on the company and the company grows, makes profits, invests and continues to grow, then the value of the company will also grow.

With a view to long-term investment, the exemplary and perhaps the most recognised case is that of the S&P 500, the index that follows the stock performance of a selection of the 500 largest capitalisation American companies. If you invested in this index, you would get an average return of 7.3% per year, without actually having to do anything more than wait. Of course, the index contains companies whose returns have been higher or lower, averaging 7.3%.

Long term vs Short term

Take the example of Starbucks, a company known to all who have had enormous returns in the long run. Let’s see what two investors would have done. The first one we will call Jack and he is a lover of long-term investments and the second one is Will, who is orientated towards short-term investments.

As you can see, although Will still made a profit, he bought his Starbucks shares in 2000 at around $7 per share and resold them in 2003 at 10% above the purchase price per share and made a capital gain. However, if he had been more patient, he would have gotten a higher return as Jack did. Like Will, Jack bought Starbucks shares in 2000 at a price of $7 per share, but chose to resell them in 2018 at a price of $55 per share, resulting in a higher capital gain.

To conclude

In short, it is obvious that the world of investment is variable and unpredictable and it is very difficult to find the right companies or the most suitable instruments, but one thing is certain and it does not depend on your investment ideas: “The most important skill of an investor is not the skill in finding the best deals, but patience in knowing how to wait for them to pay off”.

Federico Palmieri