The fact that sustainability is set to play an important role is well known. We often hear about ESG issues, i.e. the aspects that an organisation has to account for in the pursuit of its business objectives, also in the light of strong investor interest.

In detail, the acronym refers to the terms:

- “Environmental”, with a focus on the issues of climate change, resource waste, pollution and over-exploitation of natural resources;

- “Social”, which includes the relationship between the organisation and the society in which it operates, the management of employees and respect for their rights;

- “Governance”, i.e. business management systems inspired by good practices and ethical principles.

In recent years, these issues have started to closely touch large multinational companies and their integration has become the real challenge for all types of companies and investors, including start-ups and SMEs.

But let’s get to the real question: Why is it necessary to embrace the ESG challenge?

We can answer this question with two points: ESG disclosure requirements and incentives for companies that meet the criteria.

- ESG disclosure requirements

The Non-Financial Reporting Directive (Directive 2014/95/EU, “NFRD”) introduced a requirement for certain large companies to include a non-financial statement in their annual report, specifically on 4 issues:

- Environmental impacts;

- Social and employee-related issues;

- Respect for human rights;

- Corruption and money laundering.

Currently, non-financial reporting in Italy is regulated by Legislative Decree 254/2016. This obliges Italian companies listed on regulated markets, banks, insurance and reinsurance companies with more than 500 employees and which have exceeded €20 million as a balance sheet total or €40 million in turnover to prepare a sustainability report.

According to Consob, 205 Italian companies have published a sustainability report meeting the above-mentioned requirements, and many others have decided independently to adhere to the publication of this information.

In addition, the Corporate Sustainability Reporting Directive (CSRD) aims to introduce stricter transparency requirements on corporate sustainability and uniform European reporting standards, which ensure comparability of information for consumers, lenders and investors.

The achievement of these objectives is ensured through the adoption of the following measures:

- Extension of the non-financial reporting obligation to listed SMEs with securities listed on EU regulated markets;

- Expansion of the ESG information that must be compulsorily included in non-financial reporting, including business model and strategy; sustainability targets and objectives; ESG risks and management methods; sustainability Key Performance Indicators;

- Uniformity of reporting standards for all European companies;

- Mandatory certification of published information by accredited bodies.

- Facilitation for companies that comply with ESG criteria

There are several measures undertaken by the Ministry of Economic Development to promote innovative and sustainable companies.

Among these, Investimenti sostenibili 4.0 (Sustainable Investments 4.0) aims to steer the recovery of post-covid investments towards the sustainable growth of the economic system by granting and disbursing subsidies for investment programmes proposed by micro enterprises and SMEs that comply with current environmental protection principles and have a high technological content that can make a particular contribution to the sustainability objectives defined by the European Union. The overall budget of the Facility is EUR 677.87 billion.

Tax credits amounting to 15% will also be granted to companies intending to make investments aimed at achieving an ecological transition or digital innovation 4.0 objective, up to a maximum expenditure of EUR 2 million.

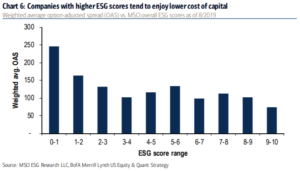

In addition to obligations and incentives to move towards a path of integration of ESG criteria, there are also several advantages that companies benefit from this choice, such as a lower cost of debt as can be seen from the chart, as well as improved business performance.

These are just some of the issues that highlight how necessary it is today to enter into the ESG logic, understand its criteria and outline an action strategy to integrate them into one’s medium- to long-term objectives.

If you would like to learn more about this topic, or if you are interested in one of our services for your company, please do not hesitate to contact us. One of our experts will be able to help you.

The BizPlace team