Startup valuation is one of the key elements in the negotiation between startup founders and potential startup investors and determines its success or failure.

How to evaluate your startup: methodologies

If you are wondering how to value your startup, then you should know that determining the valuation of startups is not simple at all because of the special nature and characteristics of these companies. In fact, the classic methods used in finance, such as discounted cash flow and the multiples method, are methods that have several limitations when applied to companies that have the characteristics of startups and especially if they are in their early years.

The methodologies for evaluating a startup

Below we try to represent valuation methodologies designed specifically for startups and useful to know and apply.

The first two are valuation methods that are particularly suited in cases of startups that are in their pre-revenue and early life stages, that is, when financial and business metrics are absent. Precisely because of the absence of history and traction, these are extremely qualitative methodologies with a strong component of subjectivity.

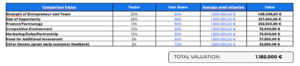

Berkus method: The Berkus valuation method was developed in 1990 by Dave Berkus, a prominent angel investor in the 1990s California scene. According to this method, categories of typical risks that a startup faces during its journey are identified and assigned a value. This is a useful tool for simply estimating the potential value of a startup, but it has a strong component of subjectivity.

Below is a practical example:

Scorecard method: The Scorecard valuation method was developed by Bill Payne, a U.S. angel investor. Unlike the Berkus method, the Scorecard broadens the analysis to include other already funded startups operating in the same industry, in fact in this case the first step is to determine an average industry valuation. The second step, on the other hand, is to find a multiplier through the sum of several key factors, each of which is assigned a percentage weight that cannot exceed a predetermined maximum value.

Below is a practical example:

Finally, the venture capital method. Unlike the previous two, this is a methodology with a greater financial character since it allows the startup to be valued based on the expected return from the investor. Below are the steps of the model:

Step 1 – An estimate of economic performance in a specific future year, not too far in the future (two to five years is the typical range), is made.

Step 2 – The value at the end of the forecast period (Terminal Value) is determined by applying the multiples method (the multiple is based on other companies in the industry that have been sold or listed)

Step 3 – The estimated value at the end of the forecast period is discounted using the investor’s target rate of return (target ROI), which is generally very high to account for the perceived risk in the business and the probability of default of the company.

Phase – Venture capitalists in exchange for contributed capital receive shares or stock in the company.

![]()

If you would like more information to help you understand how to evaluate your startup, please do not hesitate to contact us. One of our experts will be able to help you.

The BizPlace team