Who is this service for?

Company management

Investor members

Objective

Intuitive tool for internal management control and financial planning

Useful tool for monitoring key business and financial KPIs

iR Advantages

Build your report effortlessly

Guided and easily obtainable reporting with considerable time and cost savings

Share and update your data

Share and update your members on the progress of your financial and business KPIs.

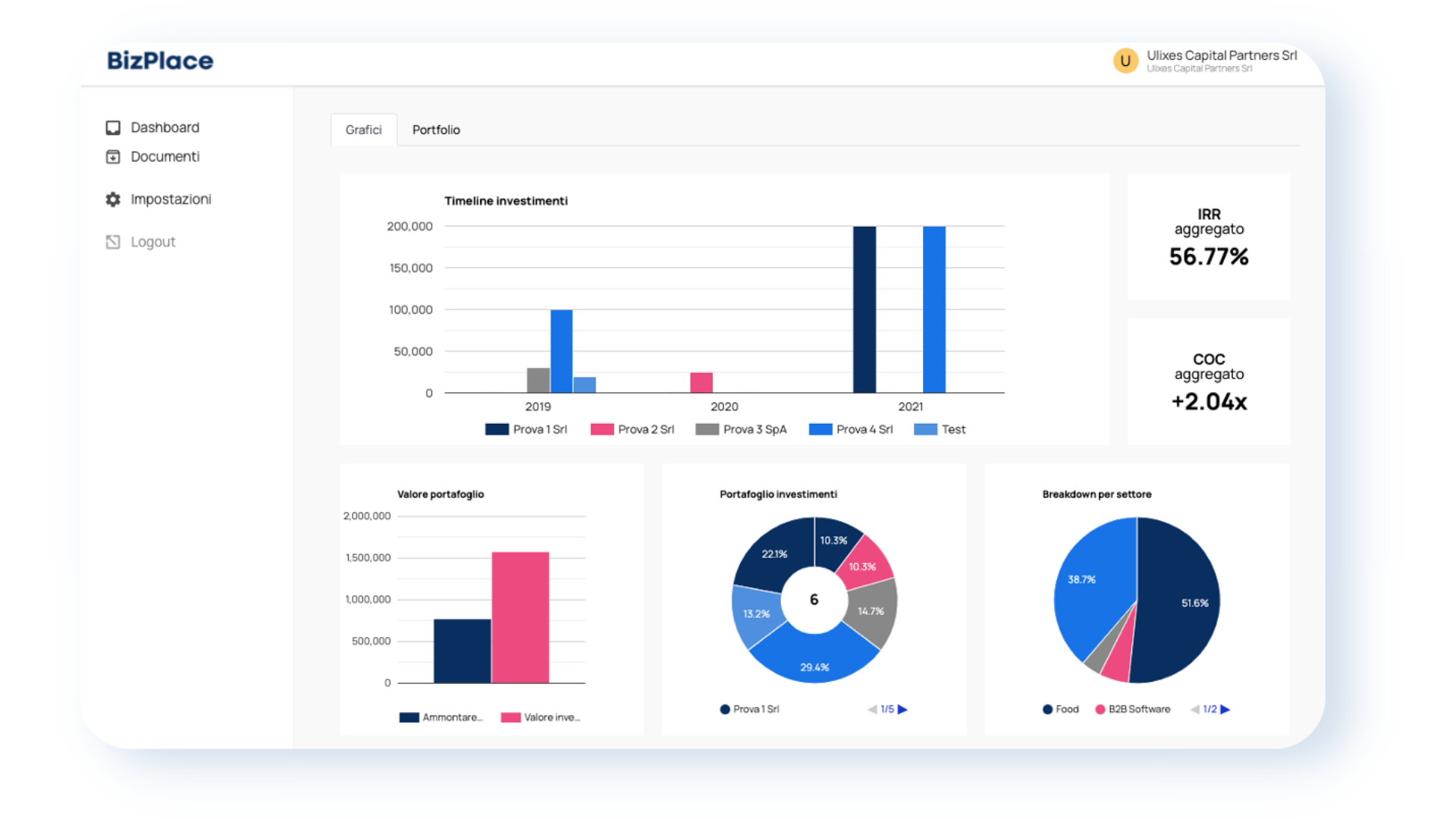

Portfolio monitoring

Monitor the progress of your portfolio immediately, accurately, consistently and on a single platform.

Monitoring single companies

View and compare the financial and business KPIs of the subsidiaries of which you are a member.

Discover more

iR Features

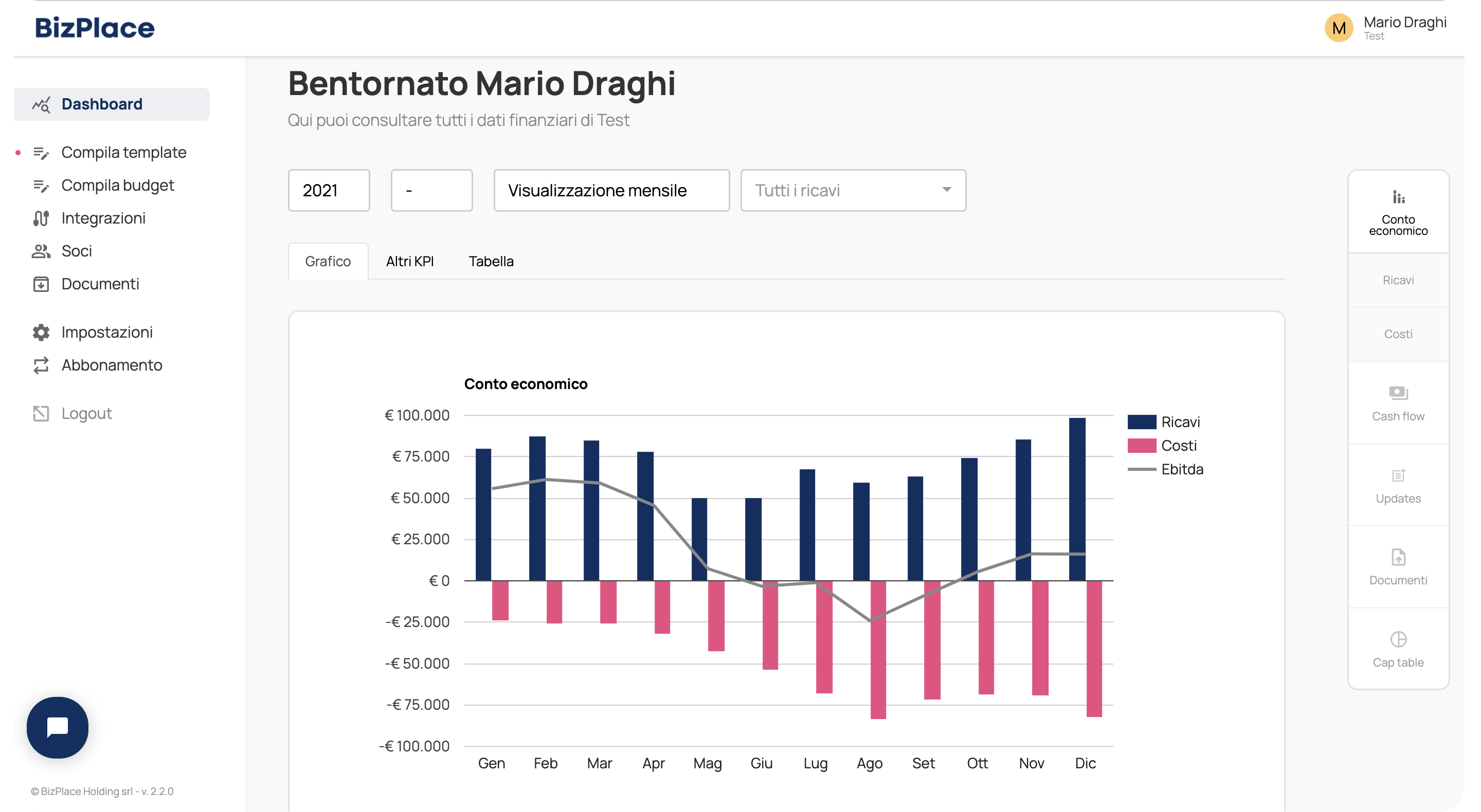

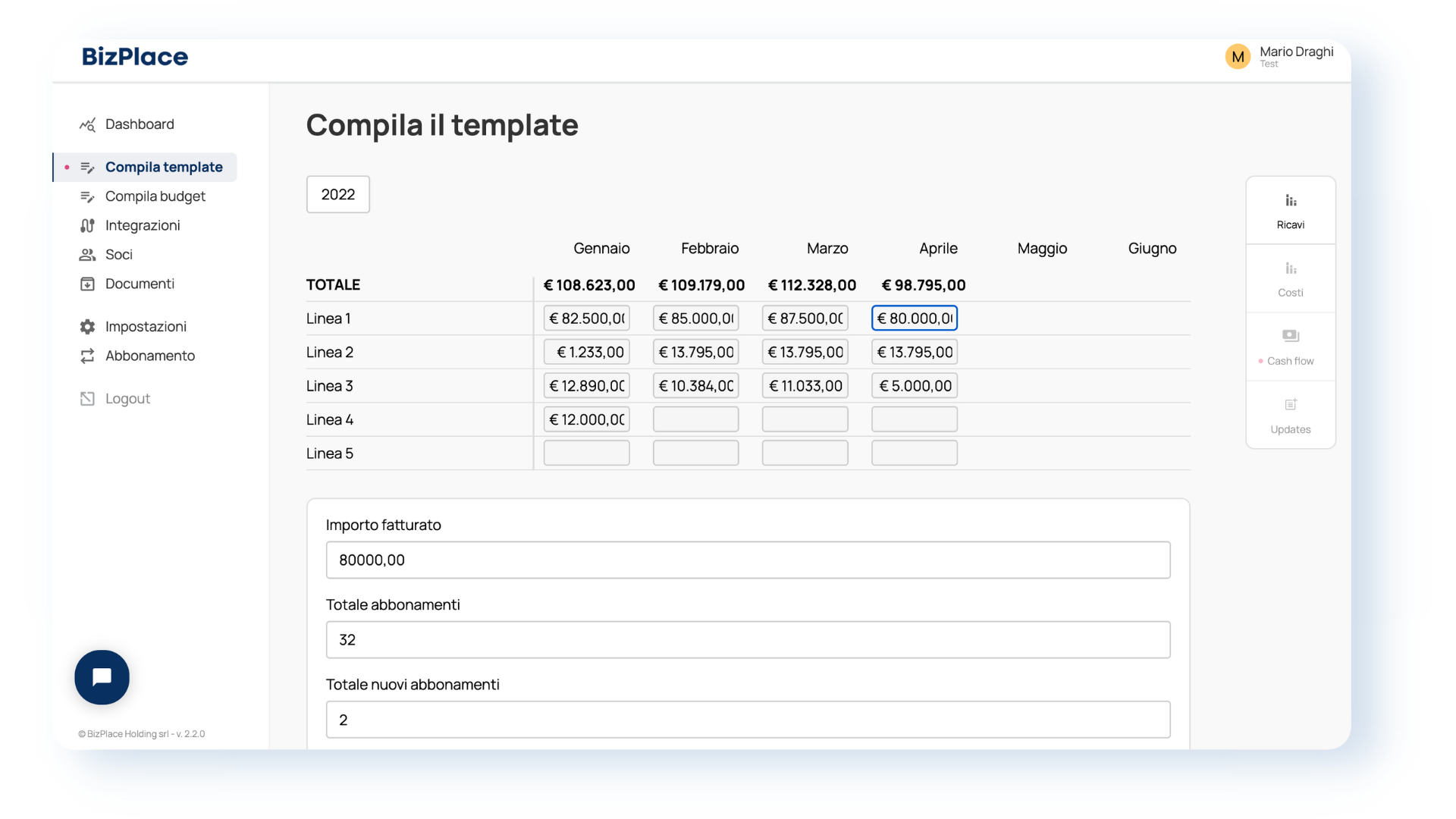

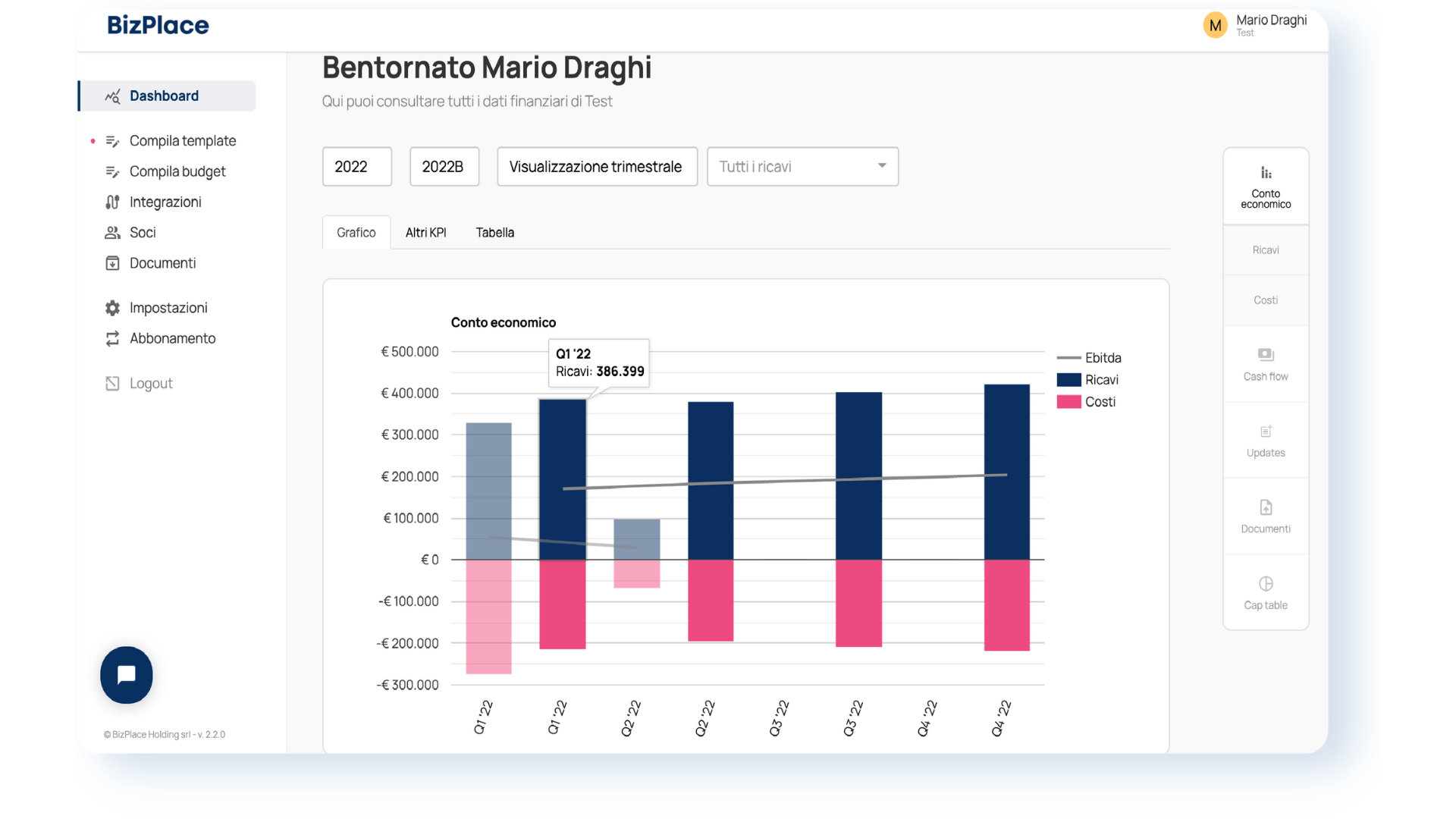

Quantitative Data

View companies’ economic and financial data on a monthly, quarterly and annual basis through graphs and tables

Data Comparison

Compare monthly, quarterly, yearly financial and business data, in aggregate or by line of business

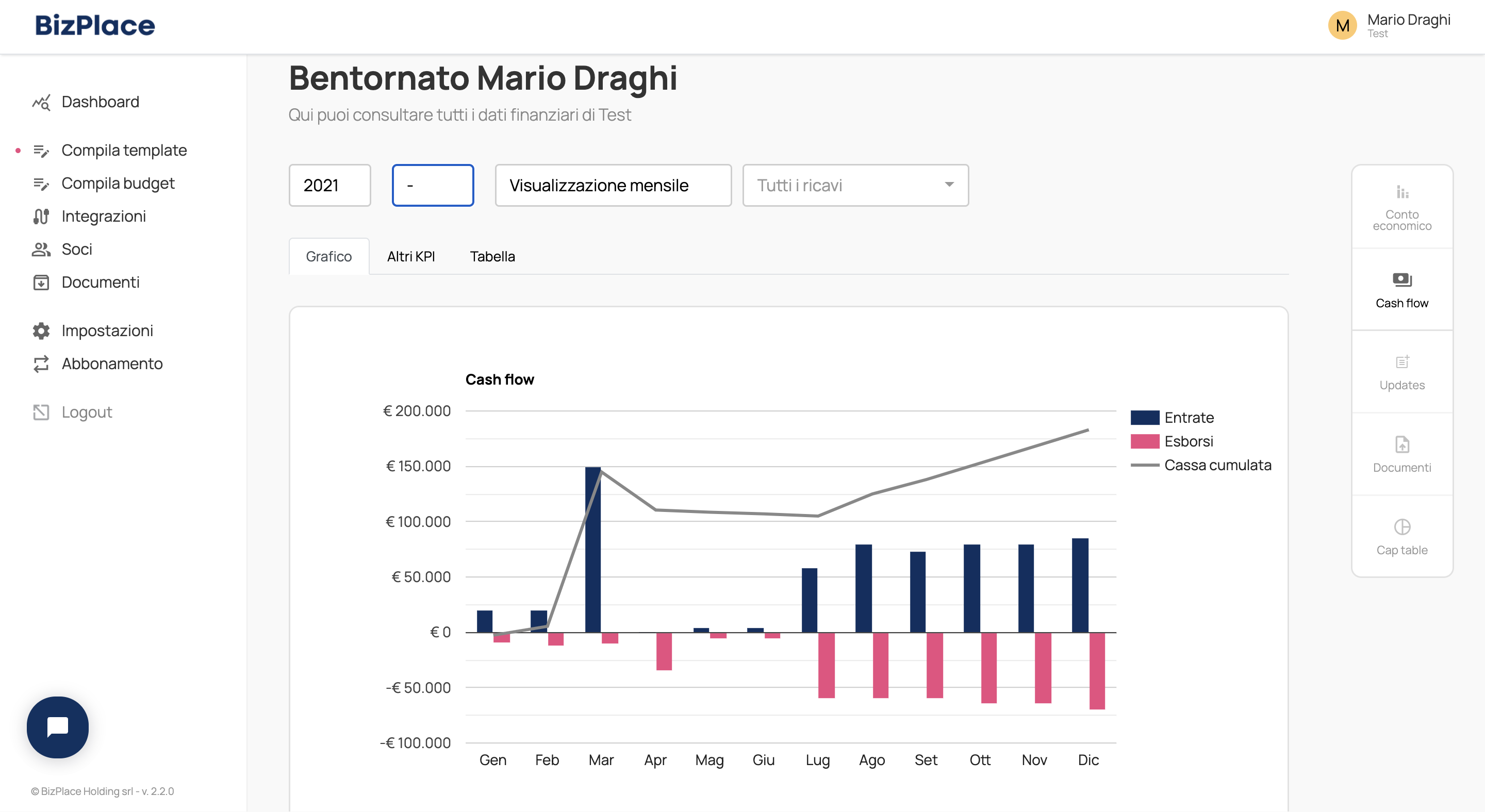

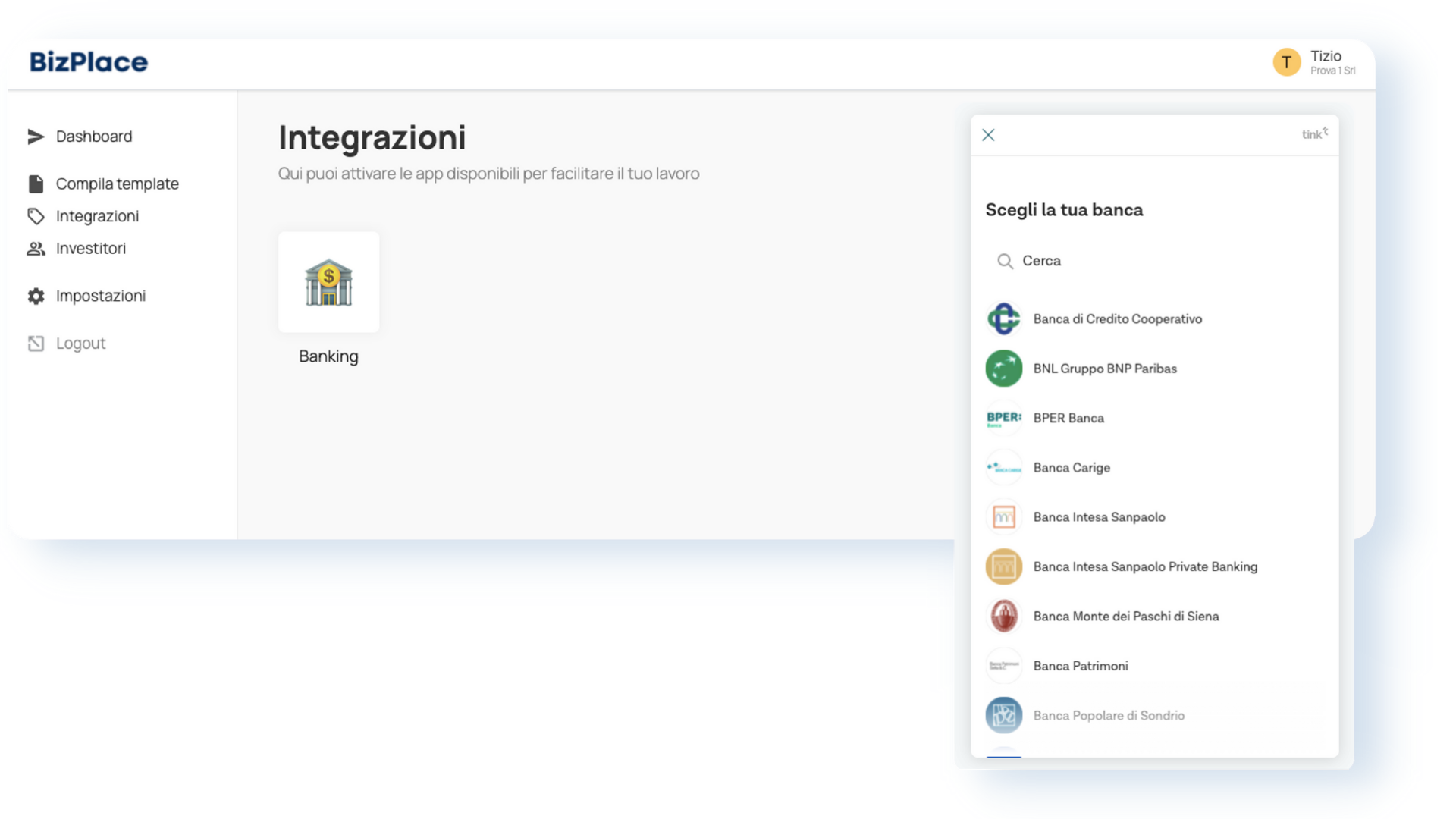

Cash Flow Automation

Keep track of company cash flow automatically by integrating your current accounts and categorising periodic income and expenditure in the software

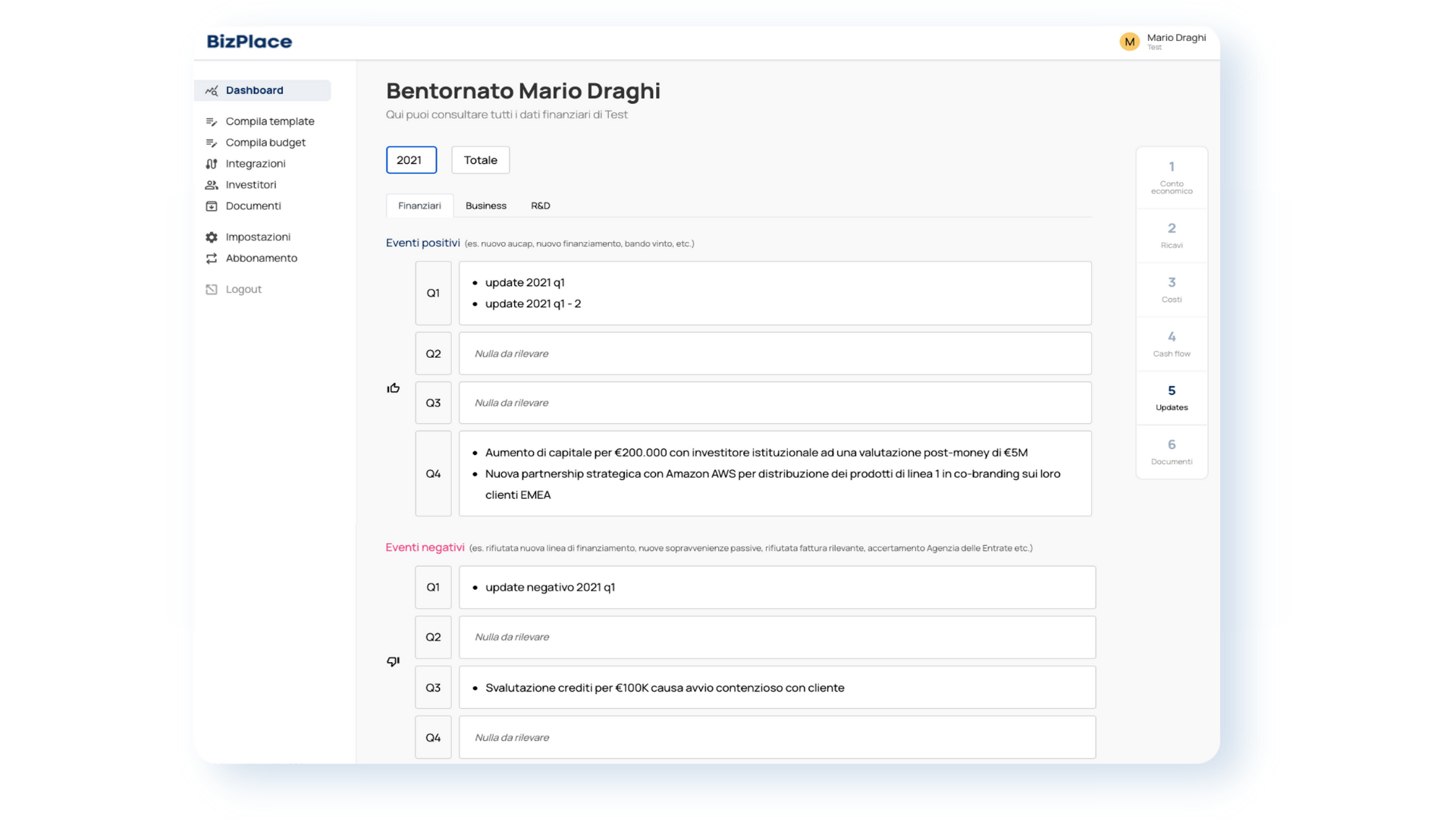

Qualitative Data

Update your investors on product, technology and business development achievements

Documents Sharing

Upload and share key company documents (visura, balance sheets, articles of association, presentations, etc.)

KPI Personalization

Define, analyse and monitor metrics of interest to companies. BizPlace can customise the software to meet the needs of companies

What are the steps to follow to use the iR software?

Setup

by BizPlace

3-5 days

Periodic Data Entry

by the Company